Washington – After a long wait, the Senate is launching action in President Donald Trump’s “Great and beautiful invoice” of tax exemptions and expenses of expenses at a risky moment for the USA and the global economy.

More than a month after the Republicans of the House of Representatives surprised Washington for Advance of your framework For the $ 4.5 billion Trump tax exemptions and $ 2 billion in expenses, the Senate Republicans voted Thursday to start working in Its version. The vote in much of the game, 52-48, prepares the stage for a potential of the All-Night Friday Senate that spills in the weekend.

But work in the multimillionaire package occurs as The markets at home and abroad are at the limit After Trump’s Great tariff schemeComplicating a political and procedural task already difficult about what Republicans expect it to become their internal signature policy package.

Leader of the majority of Senate John Thune, RS.D., opened the camera on Thursday saying that they were waiting to be ready to start.

Trump says he is aboard the plan and the Republicans, in Congress control, are eager to demonstrate that the party is advancing towards the delivery of their campaign promises. For dusk, when the vote began, a Republican, Libertarian senator Rand Paul de Kentucky, voted against, like all Democrats.

Democrats, Like the minority partyDo not have the votes to stop the republican party plan. But they intend to use the procedure tools available to prolong the process. Democrats argue that Republicans are focusing on tax exemptions for the rich at the expense of the programs and services in which millions of Americans trust to obtain help with medical care, child care, school lunches and other daily needs.

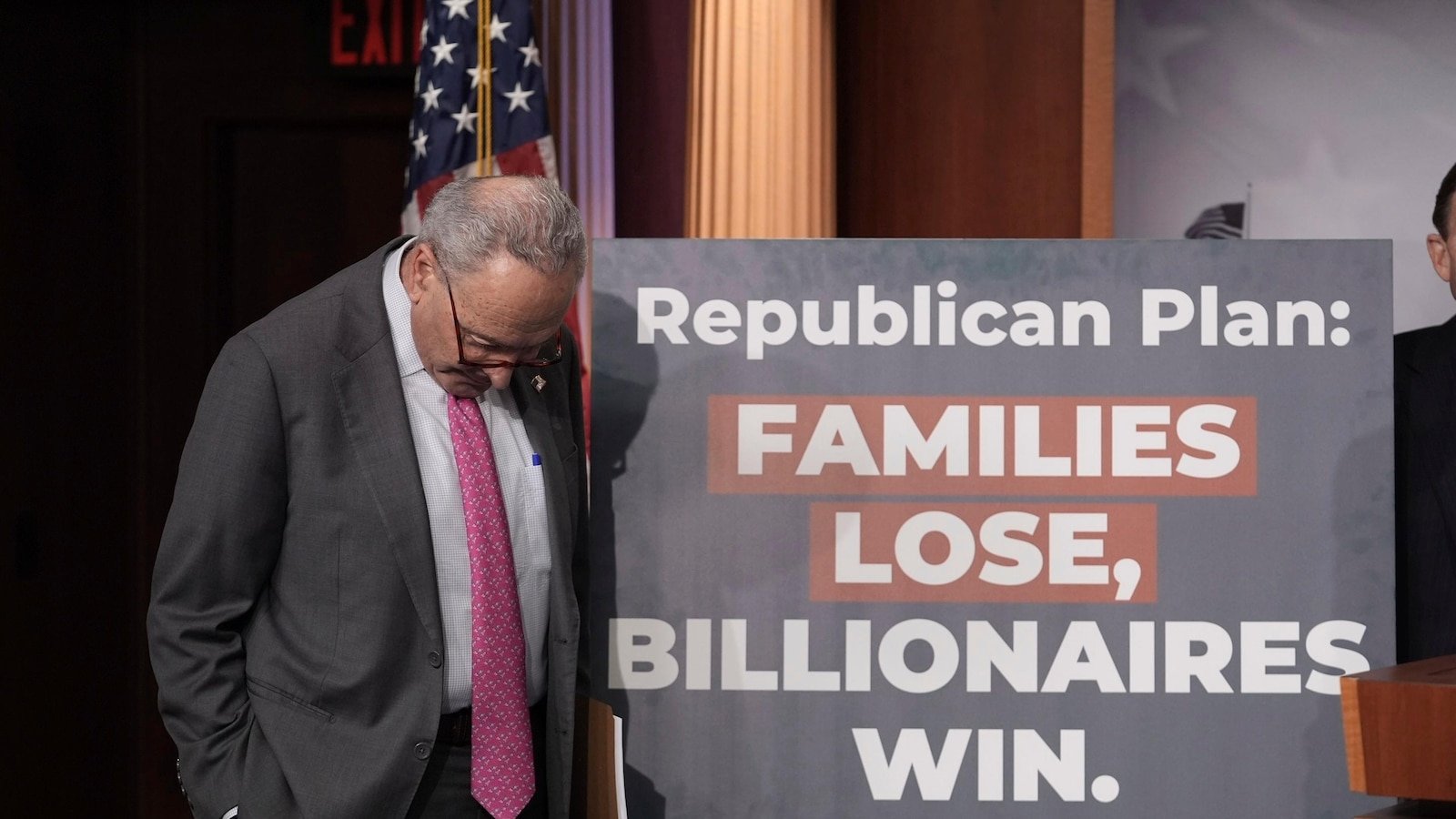

“They are bad, they are unpleasant, they are indifferent,” Senate Democratic Leader Chuck Schumer He said about Republicans. “We, tonight and tomorrow, let’s show who they are.”

The Senate Democrats began consuming up to 25 hours of their available debate time, keeping the floor at night and criticizing possible republican cuts to Medicaid, veteran programs, Duxes cuts and the impact of Trump rates.

Senator Jeff Merkley from Oregon, the Democrat of Classification in the Budget Committee, repeated a slogan that has been sharing: “Families lose and win billionaires.”

“That,” he said, “is the Republican Plan.”

Fundamental for the Senate package is to make sure that Trump’s first period tax cuts, which will expire at the end of the year, continue and become a permanent accessory of the fiscal code. The senators will also consider adding Trump’s proposed tax cuts to the salaries with tip, social security income and others.

The Senate package would also reinforce border security funds for about $ 175 billion to carry out Trump’s mass deportation campaignThat he does not have cash, and add national security funds for the Pentagon, all the priorities that the Senate Republican Party got into an earlier version that was criticized by the Republicans of the House of Representatives.

Republican senator John Barraso de Wyoming, the party whip, said the action tax cuts would expire, becoming a tax increase of $ 4 billion in Americans. “Republicans are focused on the United States returning to the track,” he said.

What is not clear is how everything will be paid, since Republican deficit hawks generally require expenses compensation to help cover lost tax revenues and avoid accumulating debt load of $ 36 billion of $ 36 of the nation.

While the Republicans of the House of Representatives approved their package with $ 4.5 billion in tax exemptions and up to $ 2 billion in expenses of expenses, the Senate Republicans are taking a different tactic.

The president of the Senate Budget Committee, Lindsey Graham They are the current policyThey are not considered new, and do not need to be compensated with reductions in spending, an approach that Democrats compare with “becoming nuclear” with normal rules, particularly if the strategy is tested with an unfavorable failure before the Senate parliamentarian.

Instead, Senate Republicans are considering compensation mainly for any new Trump tax exemption. As the alarms of the most conservative budget hawks increase, the senators have established an apartment of approximately $ 4 billion in reductions of health budget and other programs, a fraction of the expected price of $ 4 billion of more than $ 4 billion for tax exemptions.

The leaders of the Republican party are assuring the hawks of the deficit within their own ranks that the legislation says that the cuts can increase up to $ 2 billion.

After an expected vote on Friday night, to Rama, with dozens of amendments offered to the package, the senators plan to stay on Saturday if necessary to receive a final vote to approve it, sending it to the camera for the action.

The camera and the Senate will finally need to merge their frames in a final product, which is expected in May, but the intention of the president of the Mike Johnson representatives of having everything wrapped in Memorial Day could be optimistic.

The political environment is uncertain, and the public’s appetite for the steep budget cuts is being tested in real time, with Trump’s Government Efficiency Department directed by Multimillonario Elon Musk Based on federal offices, dismissing thousands of workers and closing long -term government pillars, from scientific research projects to diseases to educational services to offices that help with social security, tax presentation and climate.

At the same time, the firmer tax conservatives both in the Chamber and in the Senate, many aligned with Freedom Caucus, are pressing for even more cuts.

Trump told public and private senators this week that he would turn his back, particularly when it comes to defending expense reductions. In a White House announcing the rates on Wednesday, Trump said the Senate plan had its “total and total support.”

The president’s pronounced tariffs threw the global economy into a tail tail on Thursday, with actions worldwide, US markets leading the way.

__

Associated Press Leah Askarinam and Kevin Freking writers contributed to this report.